A few frequently asked questions about travel insurance

-

Why do I need Travel Insurance?

You should be aware that your provincial coverage may not pay for all health care costs you may incur while outside of the province, and the difference can be substantial. For example, B.C. pays $75 (CAD) a day for emergency in-patient hospital care, while the average cost in the U.S. often exceeds $1000 (US) a day, and can be as high as $10,000 (US) a day in intensive care. For this reason, you are strongly advised to purchase additional health insurance from a private insurer before you leave the province, whether you are going to another part of Canada or outside the country. You are advised to purchase additional coverage even if you plan to be away for only a day.

-

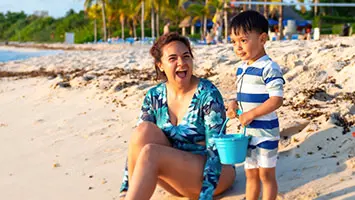

How do I get free travel coverage for my kids?

When you purchase Emergency Medical insurance for at least one adult, each dependent child 21 years of age or younger who is subsequently added to your travel policy will receive free emergency medical coverage up to $10,000,000.

-

Why should I purchase an Annual plan instead of a Single Trip Plan?

Annual plans cover you across an entire year of travel. They are the most convenient, cost-effective option if you travel more than once per year. Choose an Annual plan that will cover your longest trip outside of BC or Canada, and you’ll be covered for all the other ones in between.

-

Can I buy travel insurance if I have an existing medical condition?

Yes - Regardless of any existing conditions, we always advise members to still purchase coverage, as it will protect against all other accidents not related to that condition.

Travel insurance policies are designed to provide protection against unexpected emergency medical expenses, trip cancellation or interruption.

Depending on your age and the condition pre-existing medical conditions are covered if they are stable for a certain time period (as specified in your policy) before your policy's effective date.

It is important you review and understand any clauses or definitions in your chosen policy. Each travel insurance policy will uniquely define a pre-existing condition and there are many variations in wording. For example, policies may not cover conditions arising prior to the trip departure date:

- that are unstable

- where symptoms of an illness appeared

- that have been diagnosed or treated

- where medications have been changed

Travel policies will also specify a time frame, based on your age that relates to the evaluation of your pre-existing conditions. This time frame could be as short as 3 months but could be 1 year, 5 years or longer.

Some policies may provide coverage for your pre-existing conditions if you complete a more detailed medical questionnaire.

When purchasing our travel policy, we will evaluate pre-existing conditions for people 60 years and younger based on their health within the previous 3 months prior to the day their coverage begins. For people age 61 and over, we evaluate based on their health within 6 months prior.

-

I have a chronic illness. Am I still covered?

It depends on the illness, its seriousness and its stability. Some illnesses are easily covered. Others require a three or six month stability period, depending on your age. Blue Cross offers the possibility of covering your illness with a medical questionnaire (available for persons aged 61 and over) filled out by your treating physician; Blue Cross’ medical team will then evaluate your condition. If authorized, you can travel worry-free: your chronic illness will also be covered.

-

Are there vaccinations that I should get prior to travel?

When travelling internationally, you may be at risk for a number of diseases which are common in other parts of the world. You can learn more about Travel Vaccines on our Vaccination page.